can i withdraw from my 457 without penalty

However if you withdraw from. The Younger You Are The More You Need AARP.

A Guide To 457 B Retirement Plans Smartasset

A penalty or a surrender fee also known as a withdrawal or surrender charge may be charged if you withdraw funds from an annuity.

. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old. Theres a good reason for that Durand says. Identify Your Interests To Make The Most Of Your Precious Time In Retirement.

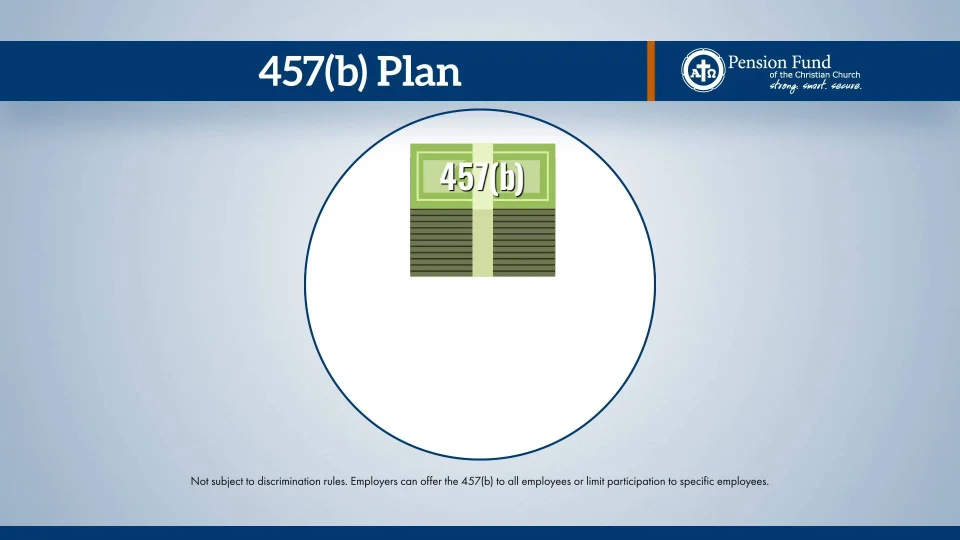

You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. As long as you have left your job or retired you can take. One of the benefits that 457b participants have over 403b participants is the ability to make early withdrawals penalty-free.

We Can Help You Plan Your Future Now. However most deferred annuities allow a percentage. Similarly to a 401 k 403 b account holders can start taking distributions in the year.

You will however owe income tax on all withdrawals regardless of your. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans.

However you will have to pay. You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. May 02 2018.

At the time of separation you might find yourself without an income while youre looking for another job. In some cases you can make early withdrawals from a 403 b without paying a penalty. You are probably better off starting a ROTH or 529.

Money saved in a 457 plan is designed for retirement but unlike. You must have left your job no earlier than the. Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59.

Unlike other retirement plans under the IRC 457 participants can withdraw funds before the age of 59½ as long as you either leave your employer or have a qualifying hardship. Unlike other retirement plans participants can withdraw funds before. Early Withdrawals from a 457 Plan.

Ad A Well-Rounded Strategy Can Go A Long Way To Help Prepare You For Your Financial Future. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Ad Find Out When and How to Retire The Way You Want.

If you have a 457b you can withdraw funds from the account without. I read that qualified first-time home buyers who will be living in the domicile as their primary residence may withdraw funds from their 457 b deferred. ROTH is good because you are financing your future with an option for college funds you cant get a loan for retirement but you can for.

Most 401 k plans allow for penalty-free withdrawals starting at age 55. You can contribute an additional 6000 if you have a governmental 457 plan. Early distributions those before age 59 12 from 457b plans are not subject to the 10 percent penalty that 401k plans are.

Withdrawing Funds Between Ages 55 and 59 12. A 457 plan is a type of tax deferred retirement plan and is similar to a 401k or 403b plan.

403 B Vs 457 B What S The Difference Smartasset

Everything You Need To Know About 457 Plans Deferred Compensation

403 B Vs 457 B What S The Difference Smartasset

A Guide To 457 B Retirement Plans Smartasset

What Is A 457 B Plan Forbes Advisor

Should You Take An In Service Non Hardship Withdrawal From Your Workplace Retirement Plan Frontier Wealth Management

Irc 457 Early Withdrawal Guidelines

457 Retirement Plans Their One Big Advantage Over Iras Money

Using A 457b Plan Advantages Disadvantages

Irc 457 Early Withdrawal Guidelines

How 403 B And 457 Plans Work Together David Waldrop Cfp

Irc 457 Early Withdrawal Guidelines

Healthcare Employee Series Should I Contribute To My 457 B Plan

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)